Payment Categories

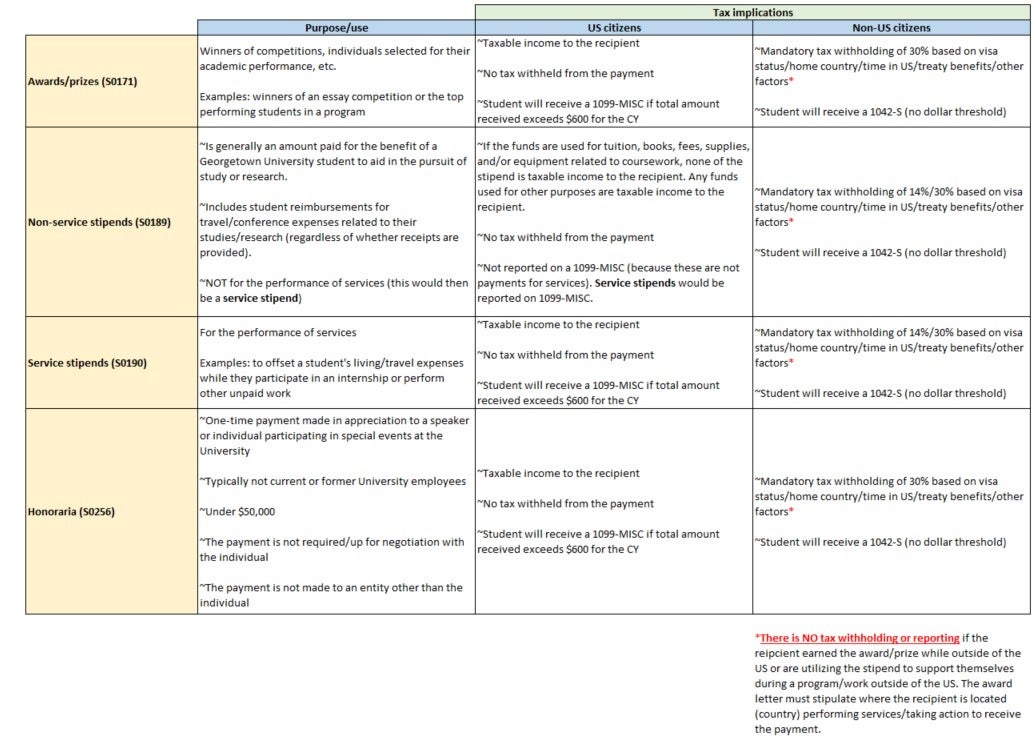

See the definitions below to determine when each payment type is appropriate. The tax implications of each payment type when paid to a US citizen vs. Non-US citizen should be considered before making a payment.

To save this chart or view larger, right-click to open in a new browser tab.

Awards and Prizes

Award and prize payees must have a Georgetown Management System (GMS) Supplier ID (SUP-XXXXXXX).

Use GMS spend category S0171 for academic prizes and awards when requesting payment through Accounts Payable. If the award or prize is not processed through Accounts Payable, the FA 162-B Gift Award Prize Policy Form must be completed and submitted to the Tax Department for proper tax reporting.

It is important that the payee understands that if Form 1099-Misc reporting thresholds are met within the calendar year, the payee will receive Form 1099-Misc with income reported in box 3 from the University’s Tax Department.

The following tax language should be in your award or prize letter:

This award represents taxable income to you and will be reported to the relevant taxing authorities as required by the IRS. For U.S. persons, if the $600 Form 1099-Misc reporting threshold is met within the calendar year, you will receive a Form 1099-Misc from the University’s Tax Department. Georgetown will not deduct any amounts from this payment or otherwise withhold any amounts on your behalf. Please note that payments made to foreign persons do not have a reporting threshold to the IRS and may be subject to tax withholding. The Tax Department encourages you to seek the advice of your tax advisor. Please review the Supplier Setup web page. If you have questions email taxdepartmentadmin@georgetown.edu.

Stipends

- Non-Service Stipends (Spend Category S0189)

For Non-Service Stipends paid to degree seeking students use GMS Spend Category S0189:

Stipend recipients who are U.S. Citizens or permanent residents will not receive a tax form from the University. However, unless the stipend is used to pay for tuition, books, fees, supplies, and equipment required of all students in the recipient’s courses, then, the stipend is taxable income. Additionally, to ensure compliance the IRS may audit the University to examine stipend award documentation.

Please use the following tax language in your Non-Service Stipend award letter or e-mail:

This stipend does not have a service obligation. Under current U.S. Tax Laws, a non-service stipend is considered a non-qualified scholarship provided for educational expenses. Georgetown University does not report non-service stipends as taxable income for U.S. citizens or permanent residents. All non-service stipend recipients must register as a Supplier Payee with the University. Please refer to the Supplier Setup web site for instructions.

International students should note that this payment will be subject to any mandatory tax withholding, generally 14% or 30%, unless there is a treaty benefit available to the recipient and the required paperwork is completed before the payment is issued. If you are a Non-U.S. Person for tax purposes and you believe you qualify under treaty benefits, please refer to this link: https://ocfo.georgetown.edu/nratax/ and contact the Tax Department if you questions.

You may find this site helpful: https://www.irs.gov/taxtopics/tc421.html. The Tax Department encourages all stipend recipients to consult with their personal tax advisor concerning any income reporting requirements.

- Service Stipends (Spend Category S0190)

Service Stipends require tax reporting. These stipends are paid using one of the following Spend Categories:

- Oth Op Exp – Service Stipend (taxable) (S0190)

- Oth Op Exp – Non-service Stipend (taxable) No IDC (S0750)

- Services – Patient Stipends – IDC (S0895)

- Services – Patient Stipends – No IDC (S0896)

- Services – Stipends (S0260)

Please use the following tax language in your award letter or e-mail:

This stipend represents taxable income to you and will be reported to the relevant taxing authorities. If you are a U.S. Citizen or permanent resident, Georgetown University will not deduct any amounts from this payment or otherwise withhold any amounts on your behalf. Non-U.S. individuals should note that this payment will be subject to any mandatory tax withholding, generally 14% or 30%, unless there is a treaty benefit available to the recipient and the required paperwork is completed before the payment is issued. All non-service stipend recipients must register as a Supplier Payee with the University. Please refer to the following site for instructions: Supplier Setup web site. Once you have your SUP number (SUP XXXXXXX), if you believe you qualify under treaty benefits, please refer to this link: https://ocfo.georgetown.edu/nratax/ and contact the Tax Department if you have questions. The Tax Department encourages stipend recipients to consult with their personal tax advisor concerning any income reporting requirements.

- Service Stipends (Paid through Payroll)

Stipends that have a service requirement are paid through Payroll Services and receive a Form W-2 and/or Form 1042-S.

Honoraria

Honoraria payees must have a Georgetown Management System (GMS) Supplier ID (SUP-XXXXXXX). For honoraria payment requests made through Accounts Payable:

Typically, an honoraria (GMS spend category S0256) is a one time payment made in appreciation to a speaker or individual participating in special events at the University. If the following statements are true, then an honoraria payment is appropriate and no additional review is required by the Tax Department:

- The individual is not a current or former Georgetown University employee

- The total payment is for $50,000 or less

- The payment is not for multiple speeches, lectures or special events

- A payment is not required or being negotiated by the individual

- The payment will not be made to an entity other than the individual

If any of the aforementioned statements is NOT true please email taxdepartment@georgetown.edu for review prior to committing to an honoraria payment. Additionally, please contact the Tax Department before committing to honoraria payments to foreign individuals. U.S. law imposes significant restrictions on honoraria payments to Non-U.S. citizens.

The Tax Department does not require a signed agreement or contract for approval of honoraria, however, departments may have procedures accounting for such payments. It is important that the payee understands that if Form 1099-Misc reporting thresholds are met within a calendar year, the payee will receive form 1099-Misc with income reported in box 7 or Form 1042-S from the University’s Tax Department.

The following tax language should be in an honoraria letter:

This honoraria payment represents taxable income to you and may be reported to the relevant taxing authorities. Georgetown will not deduct any amounts from this payment or otherwise withhold any amounts on your behalf. The Tax Department encourages honoraria recipients to consult with their personal tax advisor concerning any income reporting requirements. Please note that payments made to Non-US Citizens may be subject to tax withholding. Please review the Supplier Setup webpage and/or e-mail Tax Department if you have questions.

Donations

Donations and sponsorship recipient payees must have a Georgetown Management System (GMS) Supplier ID (SUP-XXXXXXX).

Use GMS Spend Category S0264 for donations, and S0013 for sponsorships made to external organizations. Donations and sponsorships should be made to similarly missioned 501(c)(3) organizations. Per the Approval/Signature Authorization policy, all donations and sponsorships made to external organizations $250 and over require Tax Department approval in GMS. Per the Reimbursement Policy for Employees, donations and sponsorships are not permitted to be paid on a procard or reimbursed with University funds.

Please contact University’s Tax Department before committing to making donations or sponsorships totaling over $5,000 in any fiscal year.

Research Participants

For payments to participants not made through Accounts Payable, follow the guidance outlined in this Payments to Clinical Participants Memo from the Tax Department. Complete and e-mail a pdf copy of the Clinical and Research Participant Receipt of Payment Form found on page 3 of the memo to upload.Tax_Doc.mnqzlk6wug@u.box.com.

The Tax Department combines the data provided on the Clinical and Research Participant Receipt of Payment Forms with data from Nimblify, Accounts Payable and other sources for Form 1099-MISC and Form 1042-S reporting to the IRS.

Non-Reportable Supplier Payments

Non-reportable payments are either:

- substantiated business expense reimbursements that meet the University Accountable Plan rules, or

- non-Service stipend payments to U.S. citizen students.

If a Supplier Payee anticipates receiving any other type of payment from the University, the Tax Department does not recommend registering as a ‘Non-Reportable Student’ or ‘Reimbursement’ Supplier because it may create delays with future payments.

Non-Reportable suppliers can only be U.S. Citizens for tax purposes and be paid using the following Spend Categories as appropriate:

- Non-Reportable Student Spend Categories

Accounts Receivable – Student (S0467)

Fin Aid – Financial Aid (S0098)

Fin Aid – Undergraduate (S0097)

Non-Service Stipend (no tax) (S0189)

Supplies – Student Reimbursement (S0760)

Travel & Bus – Student – Athlete Meals (S0798)

Plus all categories open to reimbursement payees below

- Reimbursement Spend Categories

Oth Op Exp – Chargebacks – Internal (S0176)

Oth Op Exp – Cost Reimbursement – No IDC (S0855)

Accounts Receivable – Student (S0467)

Accounts Receivable – Research Unbilled (S0465)

Athletics (Bats, Balls, other equipment) (S0266)

Casualty Property Claims (S0519)

Medical Supplies (S0290)

Oth Op Exp – Miscellaneous Refunds (S0188)

PNC Bank (S0454)

Reserve for Cancelled Checks (S0507)

Refundable Government Loan Advances (S0513)

Travel & Bus – Airfare – Domestic (S0325)

Travel & Bus – Airfare – International (S0326)

Travel & Bus – Baggage Fee (S0365)

Travel & Bus – Cabs, Parking, Metro, Tolls, Bus (S0265)

Travel & Bus – Car Rental (S0327)

Travel & Bus – Credits for Travel (S0262)

Travel & Bus – Hotel & Lodging – Domestic (S0328)

Travel & Bus – Hotel & Lodging – International (S0329)

Travel & Bus – Meals & Incidentals (S0364)

Travel & Bus – Mileage Reimbursement (S0330)

Travel & Bus – Miscellaneous (S0331)

Travel & Bus – Registration, Abstract, and Other Fees (S0332)

Travel & Bus – Space Rental – Event/Meeting (S0371)

Travel & Bus – Train (S0333)

Travel & Bus – Travel Agent Fees (S0334)

Refund of Revenue- Sales and Services of Auxiliary Enterprise (S0802)

Refund of Revenue- Sales and Services of Educational Departments (S0803)

Refund of Revenue- Other Sources of Revenue (S0804)

Backup Withholding

When no TIN or an incorrect TIN is provided to the payor, “backup withholding” is required, at a rate of 24% .Without a correct TIN, the payor cannot identify the appropriate amount of tax to withhold from payments to a payee; therefore, 24% will be withheld from future payments to ensure that the IRS receives tax due on this income.

If the correct TIN is provided, buta payee has underreported investment income to the IRS in the past and received a letter from the IRS subjecting the payee to backup withholding, 24% will be withheld by the payor. If the IRS has informed a payee that they are subject to backup withholding, this should be shared with payors so that they withhold the mandatory 24%.

See the IRS website for additional information.

A complete list of spend categories may be found on the GMS Worktags and Definitions page by clicking on the GMS Worktags link and opening the Job Aid – Ledger and Revenue_ Sped Category file.

Please email suppliercare@georgetown.edu for copies of Form 1099-MISC and Form 1099-NEC. Email taxdepartment@georgetown.edu for Form 1042-S.